Contrasting fortunes for tourism? What we know and don’t know as tourism ramps up

Our consumer research findings discussed in recent blogs has uncovered contrasting fortunes for tourism and hospitality. On one hand, there’s evidence of strong demand for travel and improving sentiment as COVID concerns subside. Meanwhile, on the other hand, geopolitical, economic and other global issues are coming to the fore, which may act as barriers to travel. The overall picture remains unclear as we enter the peak summer season in the Northern Hemisphere.

While global factors will continue to unfold, which will shape prospects for the travel industry in the coming weeks and months, lessons can be learned from existing behavior and views of travelers. Data from our latest consumer survey in May 2022 sheds light on aspects which are likely to influence tourism through 2022 and beyond.

International travel is gaining momentum

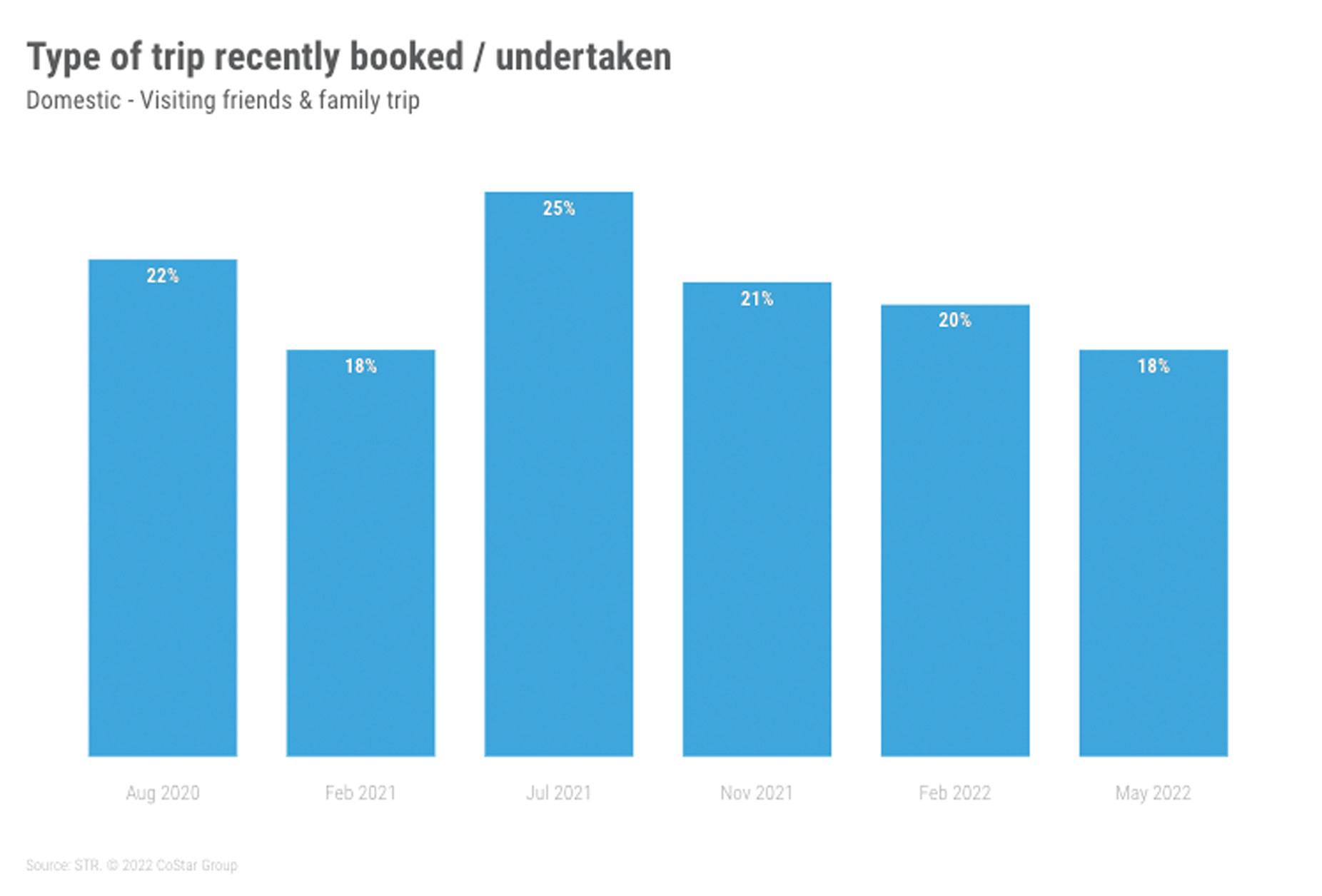

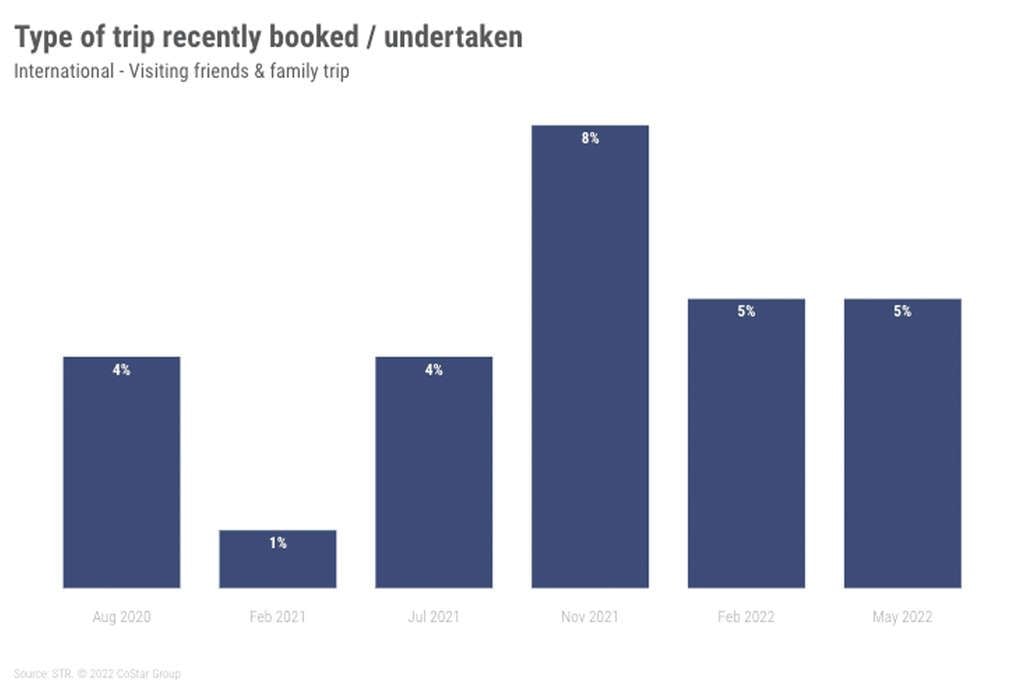

The pandemic led to many consumers shying away from longer-haul trips and, indeed, any travel which required mixing with others such as flying or public transport. In addition, complicated and ever-changing travel requirements and restrictions deterred others from venturing beyond their own borders. As a result, when restrictions were eased to allow travel, many parts of the world saw a boom in domestic tourism.

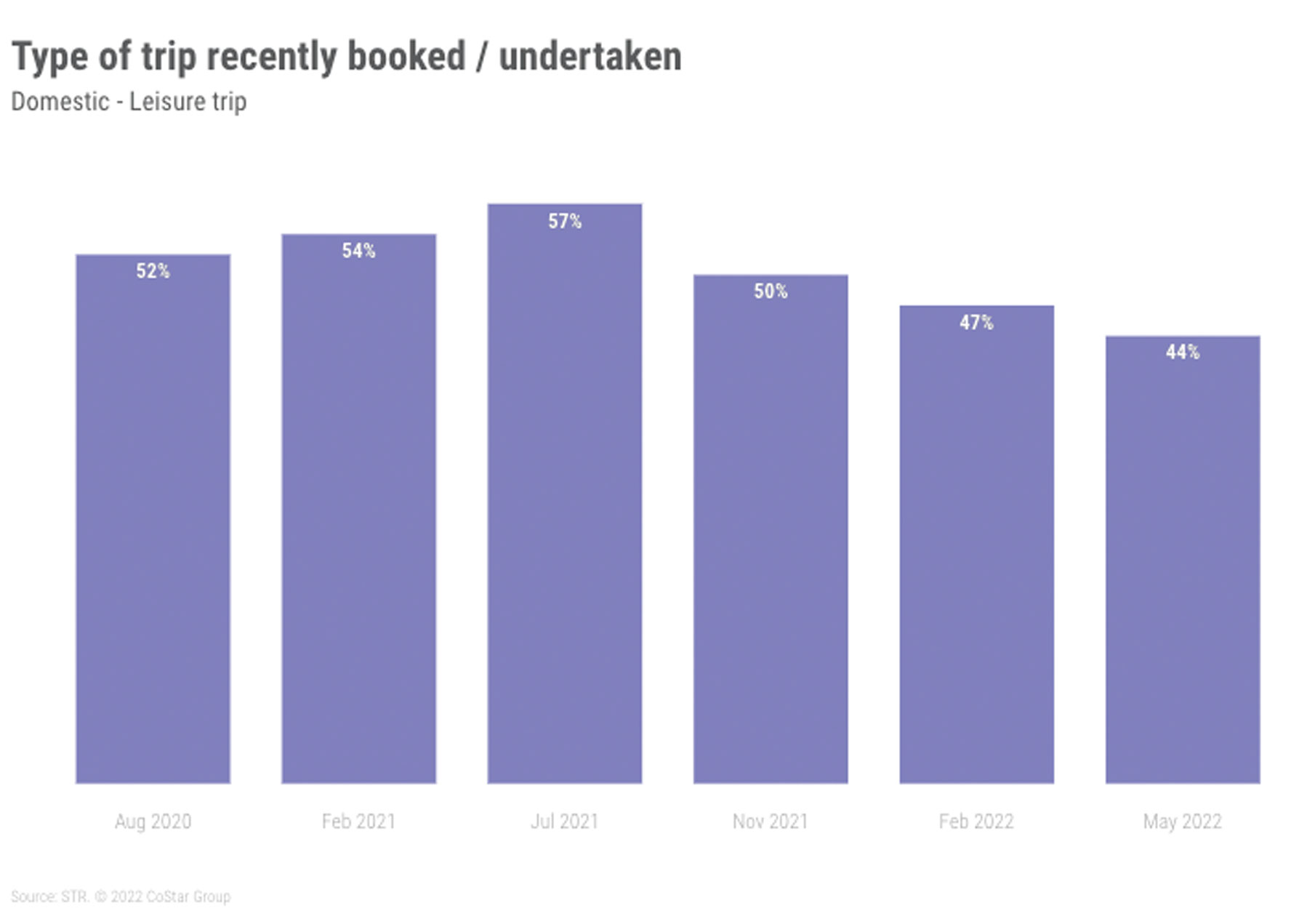

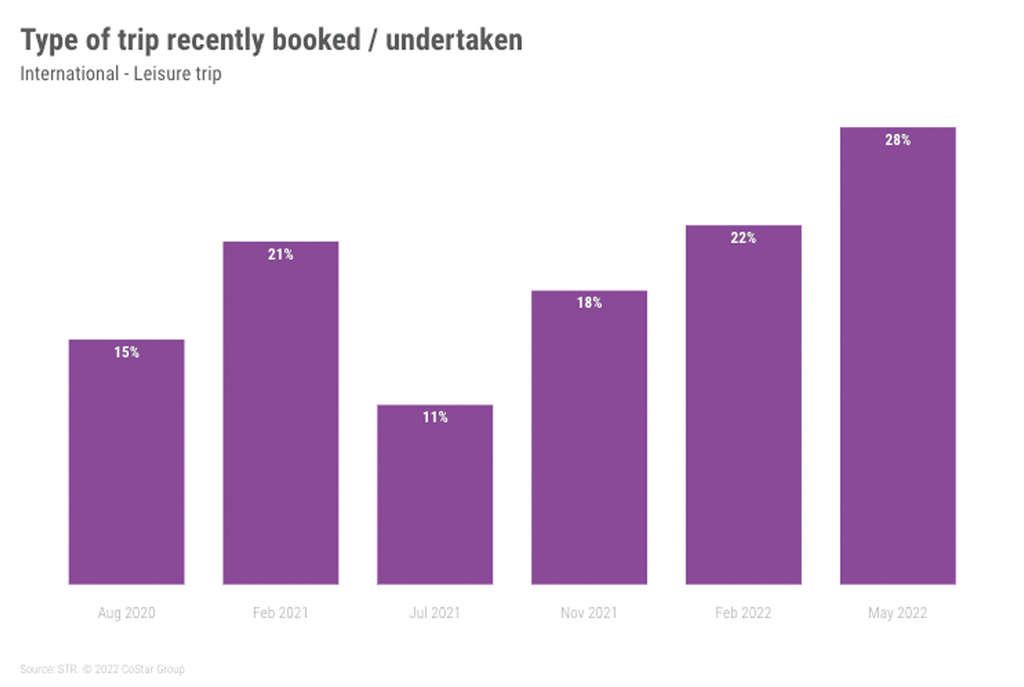

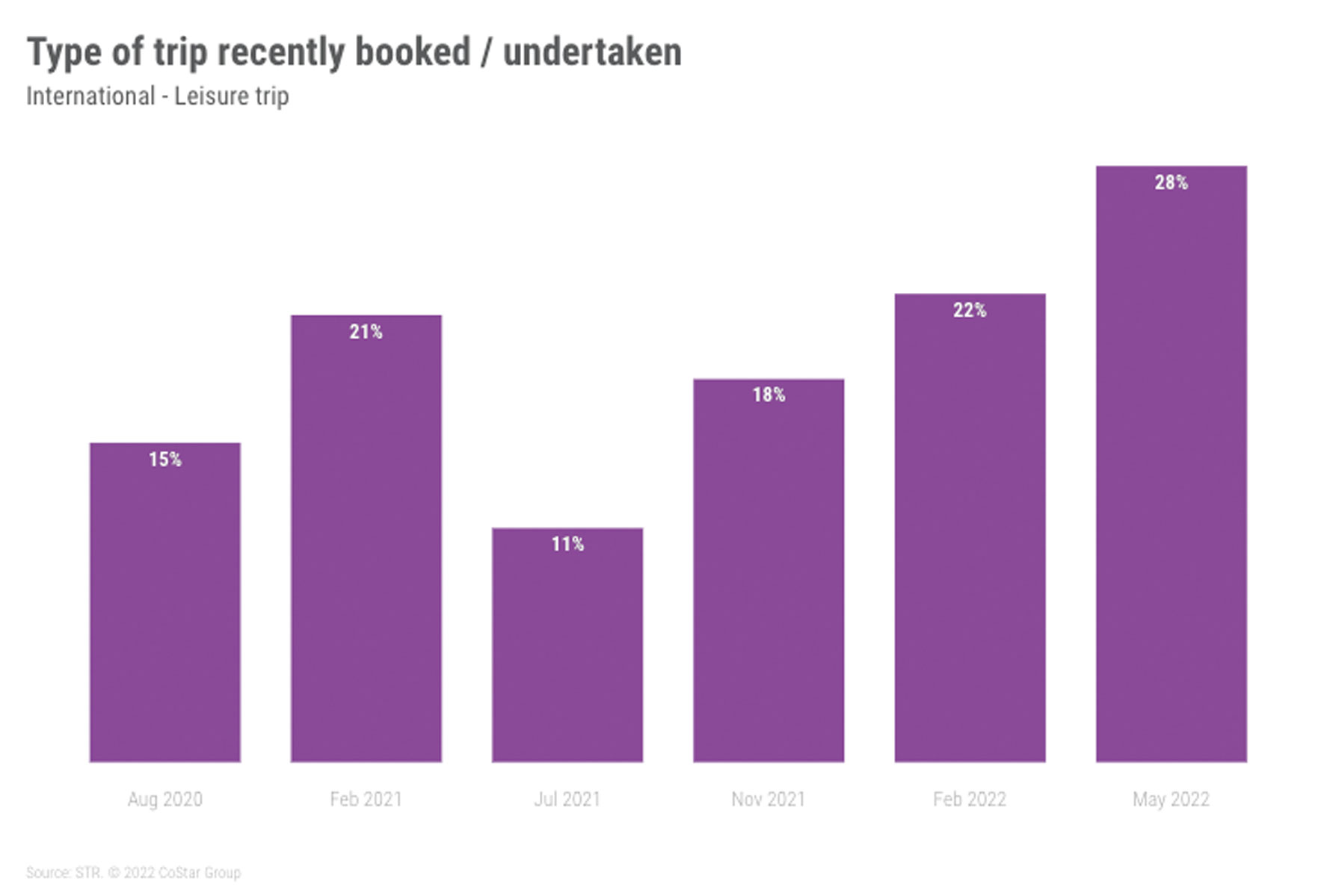

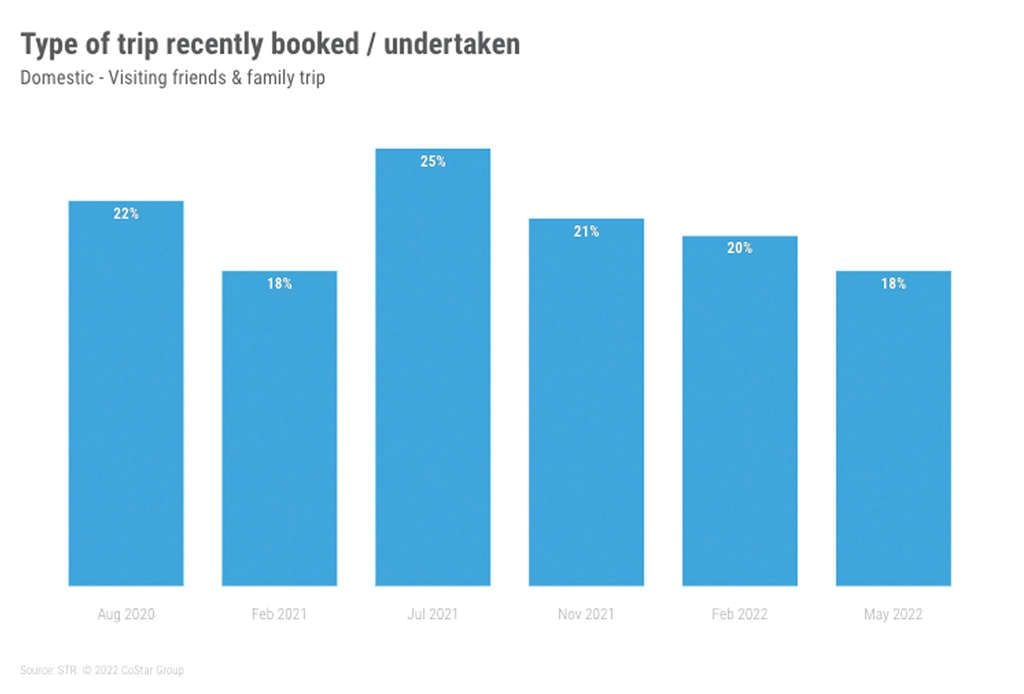

However, underlining the growing confidence in travel, our research findings show increased tendency toward international trips alongside a decline in domestic trips. Over a quarter (28%) of those who had booked or undertaken travel recently chose an international leisure break compared with just 11% of respondents asked in July 2021. Meanwhile, the proportion of domestic leisure trips decreased from 57% in July 2021 to 44% in May 2022.

Destinations of all shapes and sizes are back on the bucket list

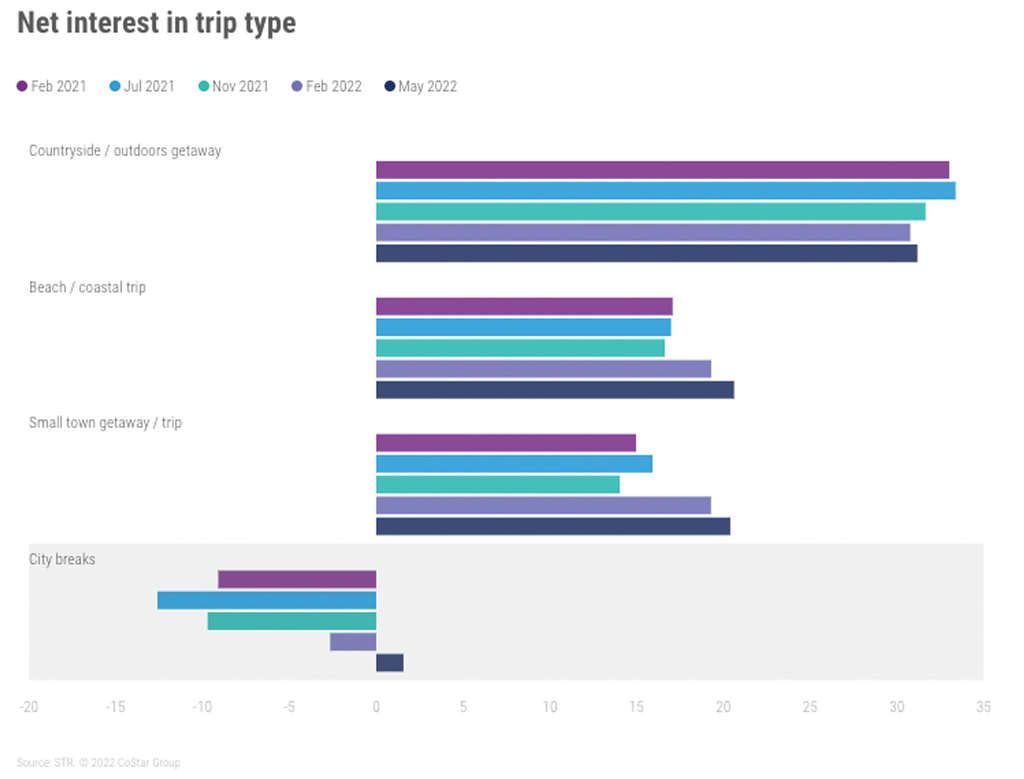

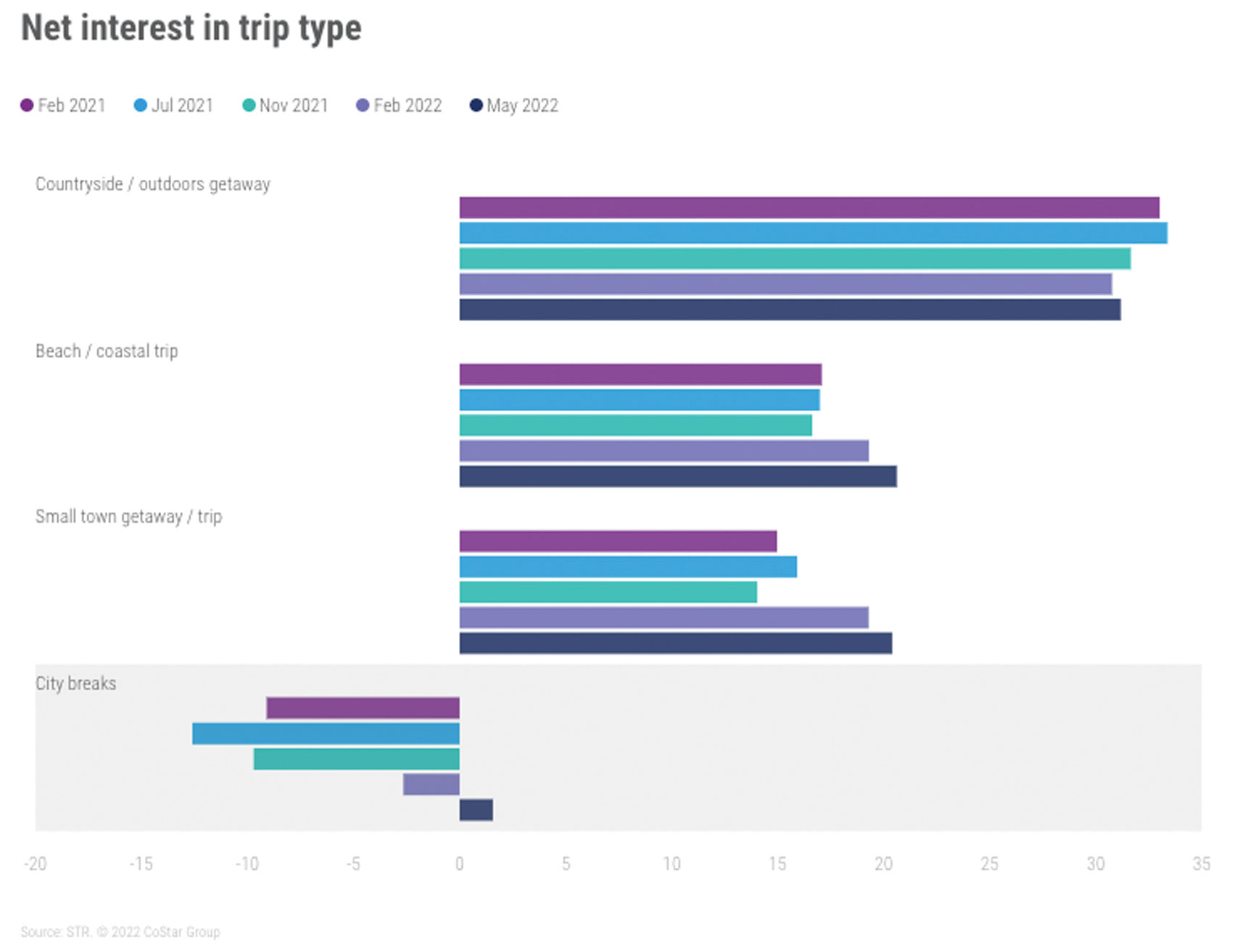

Our latest results show though that city breaks are now as popular, if not slightly more popular, than they were pre-pandemic. Net interest, the difference between those who said they are more or less interested in a type of trip now compared with before the pandemic, was +2% for city breaks in May 2022. This compares with net interest scores of -3% in February 2022, and before that net interest scores of circa -10%.

While other types of trips continue to be more vogue currently, the overall positive net interest score marks a defining moment. Consumers seem to be no longer deterred or dissuaded from visiting urban destinations—like they were previously in the pandemic.

The war in Ukraine (as well as other global factors) is muting some travel

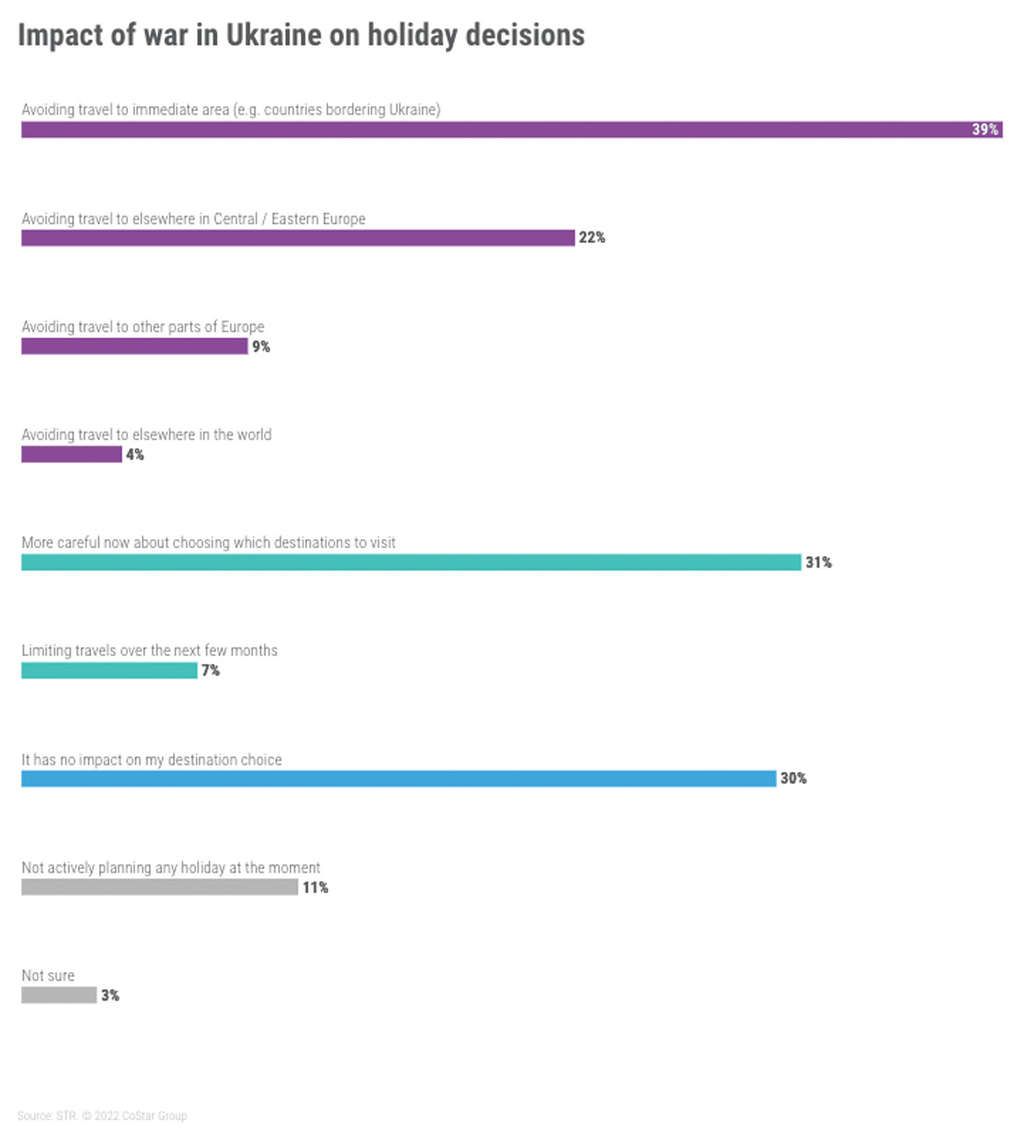

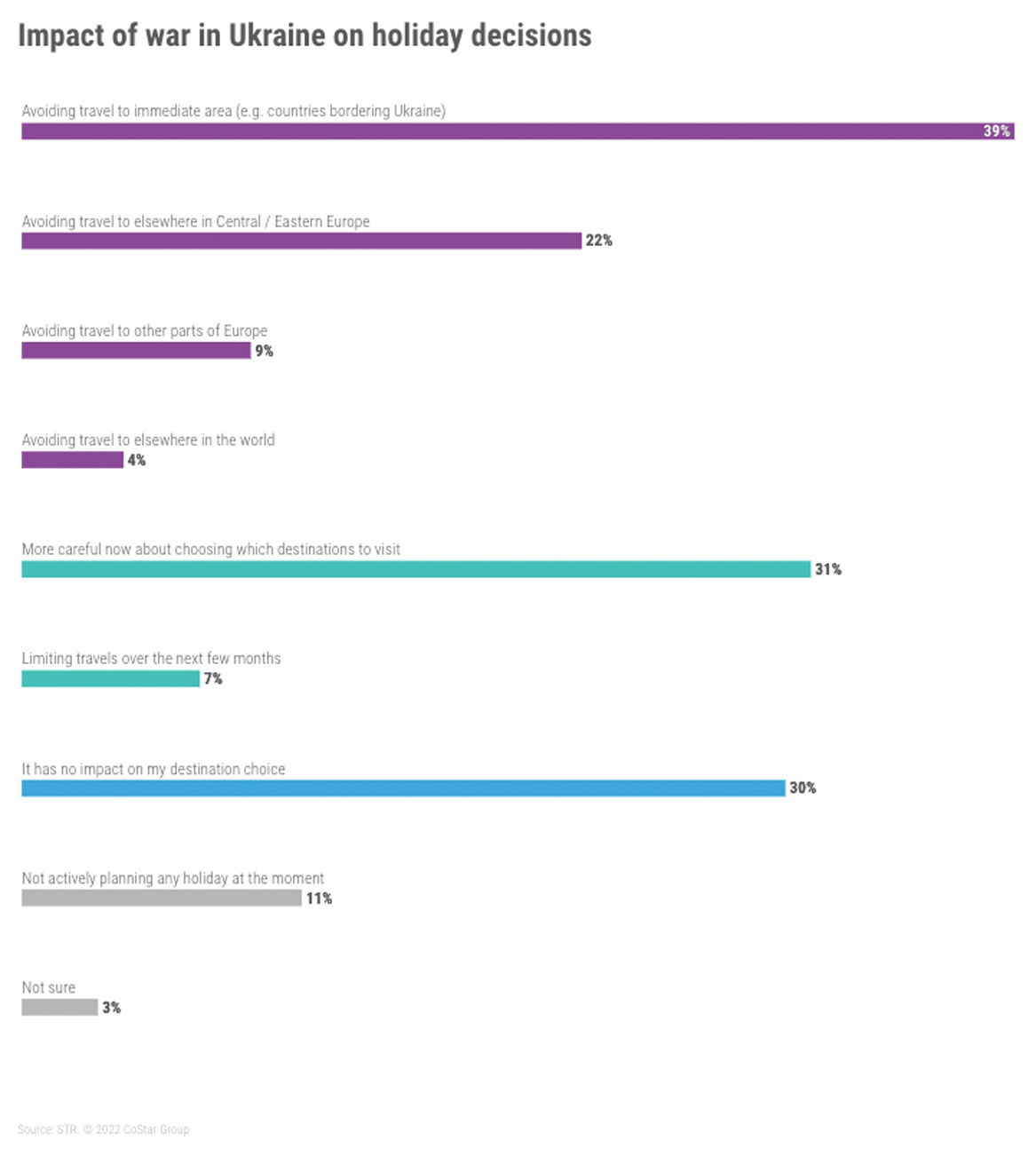

Keen to better understand current thinking about travel as the conflict continues, we asked respondents how the war in Ukraine is currently influencing their holiday destination decisions.

Most commonly (mentioned by 45%) consumers are actively avoiding destinations, especially those close to Ukraine. Perhaps surprisingly, this also includes destinations further afield. For example, 9% are avoiding travel to other parts of Europe, outside of Central and Eastern Europe. Meanwhile, 4% are avoiding other destinations elsewhere. Interestingly, those from outside Europe were more likely than others to avoid destinations not in the immediate area. This finding highlights disparities in the views of travelers and perhaps their understanding of the war, especially among those living furthest from the conflict area.

Meanwhile, some consumers are more cautious and measured because of the war, while perhaps not stopping traveling altogether. Nearly a third (31%) said they are more careful now about choosing destinations and 7% thought they would limit their travels in the coming months.

Among the remainder, there was a sense that the war has no impact on their holiday decisions (30%). This is likely due to established holiday destination preferences which have been unaffected by the war.

Conclusion

The next few months could see a collision course for tourism as opposing forces meet. Strong underlying demand for travel, improving COVID-19 sentiment and high, albeit falling, personal saving rates will continue to drive up tourism arrivals and, hence, hotel occupancy. However, intensified financial concerns, linked to the upward spiral in inflation and its impact on the global economy, may weaken this positive momentum. Other factors such as the war in Ukraine as well as staffing and operational challenges, which continue to hamper the industry today, are also likely to dent growth.

For more industry information each day, follow us on LinkedIn, Facebook, and Twitter.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.

View source

Recent Posts

- U.S. Travel Announces 2024 Hall of Leaders Honorees

- Comment: Cruise is part of the solution, not the problem

- World of Hyatt Announces Exclusive Alliance with Under Canvas, the Leader in Upscale Outdoor Hospitality, Adding More Immersive Experiences for Guests and Members

- Asia Pacific Hospitality Newsletter – Week Ending 19 July 2024

- Luton promises quicker security checks with new scanners

Recent Comments